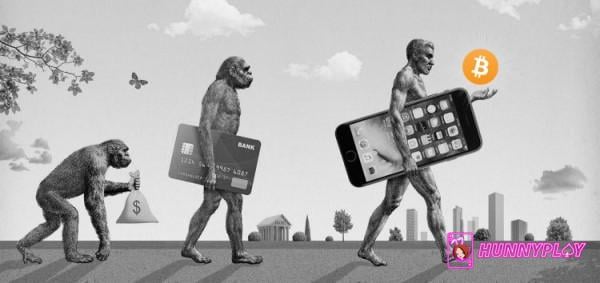

In the fast-paced world of online casinos, the choice between crypto vs fiat currencies is becoming increasingly important. In this comprehensive guide, HunnyPlay will delve into the key differences between 2 kinds of currency, empowering you to make the most informed decisions for your gaming and financial strategies.

What is Fiat Currency?

To compare crypto vs fiat currencies, let’s start with fiat currencies. Like the US dollar or Euro, they are government-issued legal tender.

Unlike historical currencies backed by commodities like gold, their value is intrinsically linked to government stability and economic health.

The amount of fiat currency in circulation plays a pivotal role: an oversupply, often due to excessive printing, leads to devaluation – essentially diluting the worth of existing money.

Central banks, like the Federal Reserve, act as the guardians of a nation’s monetary system. While most transactions occur digitally, these institutions still collaborate with government bodies, such as the US Treasury, on the physical production of currency.

Though often part of the government structure, central banks typically operate with a degree of autonomy, akin to private corporations.

Fiat money is a currency issued by central banks of countries. (Source: Internet)

To manage the money supply, central banks employ a strategy known as open-market operations.

They can effectively inject new money into the economy by purchasing assets like treasury bonds, or conversely, reduce the money supply by selling off assets from their balance sheets.

This careful balancing act aims to maintain price stability and foster economic growth.

The Emergence of Cryptocurrency

Comparing crypto vs fiat, cryptocurrencies have emerged as a revolutionary new asset class, disrupting the traditional financial landscape.

Leveraging blockchain technology or similar distributed ledgers, they offer a secure, transparent, and immutable way to record transactions.

This innovation has opened the door for cryptocurrencies to function as stores of value, speculative investments, and even keys to unlock unique utilities within specific platforms.

One of the early challenges for crypto vs fiat was their infamous volatility, hindering their role as a reliable store of value. However, the advent of stablecoins, pegged to stable assets like the US dollar, has significantly addressed this issue.

Stablecoins combine the benefits of cryptocurrency, such as fast transactions and borderless transfers, with the stability of traditional currencies.

This innovation has expanded their potential for both everyday use and as a hedge against volatility in the broader crypto market.

Crypto vs fiat indeed has many differences. Unlike fiat currencies governed by central banks, many cryptocurrencies rely on decentralized mechanisms like automated market makers (AMMs) and liquidity pools to determine their value.

This approach often mirrors the principles of representative currencies, where the value is intrinsically linked to an underlying asset.

Crypto is a currency created by blockchain technology. (Source: Internet)

To illustrate, imagine a hypothetical “A-coin” with a liquidity pool of 100 A-coins and $100. Initially, each A-coin is worth $1. Adding 100 more A-coins would automatically rebalance the value to $0.50 per A-coin.

This dynamic valuation mechanism is a key differentiator for cryptocurrencies, providing a level of adaptability and potential for growth not seen in traditional fiat currencies.

Key difference between Crypto vs Fiat: A Detailed Comparison

Privacy

First, the difference between cryptocurrency and fiat currency can be expressed in their privacy. Fiat transactions leave a clear trail, making it relatively easy to trace the individuals involved.

Personal information, bank accounts, and transaction histories are often linked, raising privacy concerns for some users.

Crypto vs fiat, on the other hand, offers a degree of pseudonymity. While transactions are recorded on the public blockchain, they are associated with wallet addresses, not personal identities.

This veil of anonymity makes it significantly more difficult to trace the origins of a transaction, appealing to those who prioritize financial privacy.

Use in global transactions

Sending fiat currency across borders often involves a cumbersome and costly process. Traditional financial institutions act as intermediaries, leading to delays and significant fees, particularly for smaller transactions.

Crypto vs fiat, offers a stark contrast. It empowers users to transact globally with unprecedented speed and efficiency.

Leveraging smart contracts to automate blockchain transactions, cryptocurrencies eliminate the need for intermediaries. This streamlines the process, reduces costs, and opens up new possibilities for international commerce and financial inclusion.

Security

Fiat currency, existing in both physical and digital forms, often benefits from the security measures of banks and law enforcement.

However, the risk of large-scale theft remains a concern, with occasional cases leading to significant losses that may never be fully recovered.

Crypto vs fiat, on the other hand, are inherently digital, eliminating the risk of physical theft. Their security relies on advanced cryptography, making them virtually impossible to counterfeit.

Transaction records are immutable, and accessing cryptocurrency wallets requires a private key, adding another layer of protection.

However, the decentralized and unregulated nature of cryptocurrency can create opportunities for scams. For instance, malicious actors could create counterfeit tokens mimicking legitimate ones, potentially deceiving unsuspecting investors.

While experienced users can easily differentiate between legitimate and fraudulent tokens, newcomers may fall victim to such schemes.

The high level of security makes cryptocurrencies virtually impossible to counterfeit.

Stability of value

Fiat currencies are generally considered more stable than their crypto counterparts, offering predictable value for everyday transactions. However, this stability isn’t absolute.

The U.S. dollar, for instance, has experienced significant devaluation over centuries, albeit gradually enough for most to adapt.

On the other hand, hyperinflation events, like the Zimbabwean dollar’s dramatic 76% plunge in 2022, demonstrate the potential for sudden and devastating value loss.

Crypto vs fiat, infamous for their volatility, can experience unprecedented price swings. Bitcoin, as a prime example, soared from $100 in 2013 to a staggering $40,000 in 2021, only to lose nearly half its value in the following year.

While stablecoins aim to address this volatility by pegging their value to stable assets, recent events like the collapse of TerraUSD have exposed vulnerabilities in some stablecoin models, underscoring the importance of careful evaluation and risk management.

Regulatory climate

The last difference between cryptocurrency and fiat currency is about their regulatory climates. Fiat currencies operate within a well-established regulatory framework, overseen by central authorities.

This structure aims to safeguard against fraud, money laundering, and other illicit activities.

Central banks play a pivotal role, controlling the money supply, setting interest rates, and collaborating with government agencies to implement monetary policy.

In stark contrast, the regulatory landscape for crypto vs fiat, is still nascent and evolving. Consumer protections that are commonplace in the fiat world are often lacking in the crypto space.

The rapid evolution of these technologies has presented challenges for regulators, struggling to keep pace with the growing adoption of cryptocurrencies.

However, recent years have seen increased efforts towards regulation, with entities like the White House and the Securities Exchange Commission in the United States actively working on establishing a framework for cryptocurrencies.

Additionally, different regions have adopted their own unique stances.

The Future of Money: Predictions and Possibilities

The future of crypto vs fiat currencies is a captivating landscape, marked by the ongoing clash between traditional fiat currencies and the burgeoning world of cryptocurrencies.

While fiat remains deeply entrenched in global financial systems, the rise of crypto signifies a potential paradigm shift.

As cryptocurrencies mature and gain wider acceptance, their potential to disrupt the status quo grows.

The promise of decentralized finance (DeFi), increased financial inclusion, and faster, cheaper cross-border transactions are just a few of the compelling arguments for crypto’s growing relevance.

However, the future is unlikely to be a binary choice. A hybrid model, where fiat and cryptocurrencies coexist and complement each other, seems increasingly plausible.

Ultimately, the future of money will likely be defined by adaptation and innovation.

As both fiat and crypto evolve, their interplay will shape the financial landscape, offering consumers and businesses a diverse range of options to manage and transact with their assets.

The journey is just beginning, and the possibilities are as exciting as they are uncertain.

The development of cryptocurrencies opens up opportunities to widely popularize decentralized finance (DeFi). (Source: Internet)

Making Informed Decisions

Cryptocurrencies offer exciting opportunities, but it’s crucial to approach them with informed decisions.

Thoroughly research any cryptocurrency or project before investing, understanding its technology and potential risks. Start with a small investment to gain experience and avoid overexposure.

Diversify your portfolio by allocating funds to various cryptocurrencies and traditional assets like fiat. This strategy helps mitigate risk and protect your investments against the volatility inherent in the crypto market.

Remember, cryptocurrencies can experience significant price swings, so be prepared for fluctuations and adopt a long-term investment approach.

Finally, prioritize security by using a reputable crypto wallet to safeguard your holdings. Remember, if you don’t control your keys, you don’t control your crypto!

Conclusion

Crypto vs fiat each present distinct advantages and drawbacks. While fiat offers familiarity, stability, and widespread adoption, cryptocurrencies boast potential for high growth, decentralization, and enhanced privacy.

The ideal choice depends on individual preferences and financial goals. As the financial landscape continues to evolve, staying informed and adapting to new technologies will be key to navigating the exciting future of money.

Hopefully the information provided by HunnyPlay has helped you have a more detailed perspective on cryptocurrency vs fiat currency of the Fintech field. Follow for more!